What You Should Know About Woodinville’s Budget

Key Takeaways:

The City of Woodinville is facing a -$0.5 million budget deficit in 2025-2026, which increases to -$1.4 million without revenue from 8,633 traffic speed camera tickets (62% of Woodinville’s population).

59% ($38.3 million) of the City’s capital investments are allocated to the creation of a new district where nobody currently lives. Less than half of it is covered by grants.

Only the design phase of the Eastrail Multimodal Trail and Wilmot Gateway Park stage and boat launch will be completed in 2025-2026. The costs to actually build these improvements are unknown and funding is not yet identified.

The City will take by eminent domain and give away $6 million in land to the Northshore Parks and Recreation Service Area (NPRSA) in hopes of attracting a future recreation center.

Three Woodinville neighborhoods that comprise 54% of homes will receive only 14% ($5.4 million) of the City’s capital investments.

Only 8% ($5.3 million) of the City’s capital investments are allocated to pedestrian and bike safety initiatives.

Every two years the City of Woodinville prepares a biennial budget, which is a projection of its revenue, costs, and planned investments in new infrastructure. Much like a household budget, the City’s budget is based on numerous assumptions and is likely to change based on economic conditions and actual expenditures. Think of it as a presentation on how the City wants to use your money.

This article will demystify the City’s 2025-2026 budget to help you better understand Woodinville’s financial position and investment priorities.

Just the Facts

Budget documents can be challenging to follow. The official 2025-2026 Adopted Biennial Budget is 151 pages, which the majority of residents are (understandably) unlikely to read. We analyzed the data and created a high-level summary of the City’s balances, revenues, and expenditures:

Starting Balances

Total Beginning Fund Balances: $69.2 million

(Money carried over from prior years.)

Operating (Day-to-Day) Budget

Operating Revenues: $46.0 million

(Taxes, permits, intergovernmental support, fees, etc.)Operating Expenditures: $46.5 million

(Includes Council, Executive, Administration, Law Enforcement, Parks, Streets, etc.)Net Operating Margin: –$0.5 million

(Spending exceeds revenue in day‐to‐day operations.)

Capital & Non‐Operating Budget

Capital/Non‐Operating Revenues: $43.3 million

(Funds for major projects—e.g., roads, facilities, land acquisition.)Capital/Non‐Operating Expenditures: $64.1 million

(Costs for big‐ticket improvements and one‐time projects.)

Ending Balances

Total Ending Fund Balances: $45.3 million

(What’s left in all funds combined at the end of 2026.)

Second Consecutive Deficit

You may have heard that the city has a balanced budget. This is a false narrative carefully crafted by a relatively new City Council majority who are defending three seats in the 2025 General Election. It is actually the city’s second consecutive deficit.

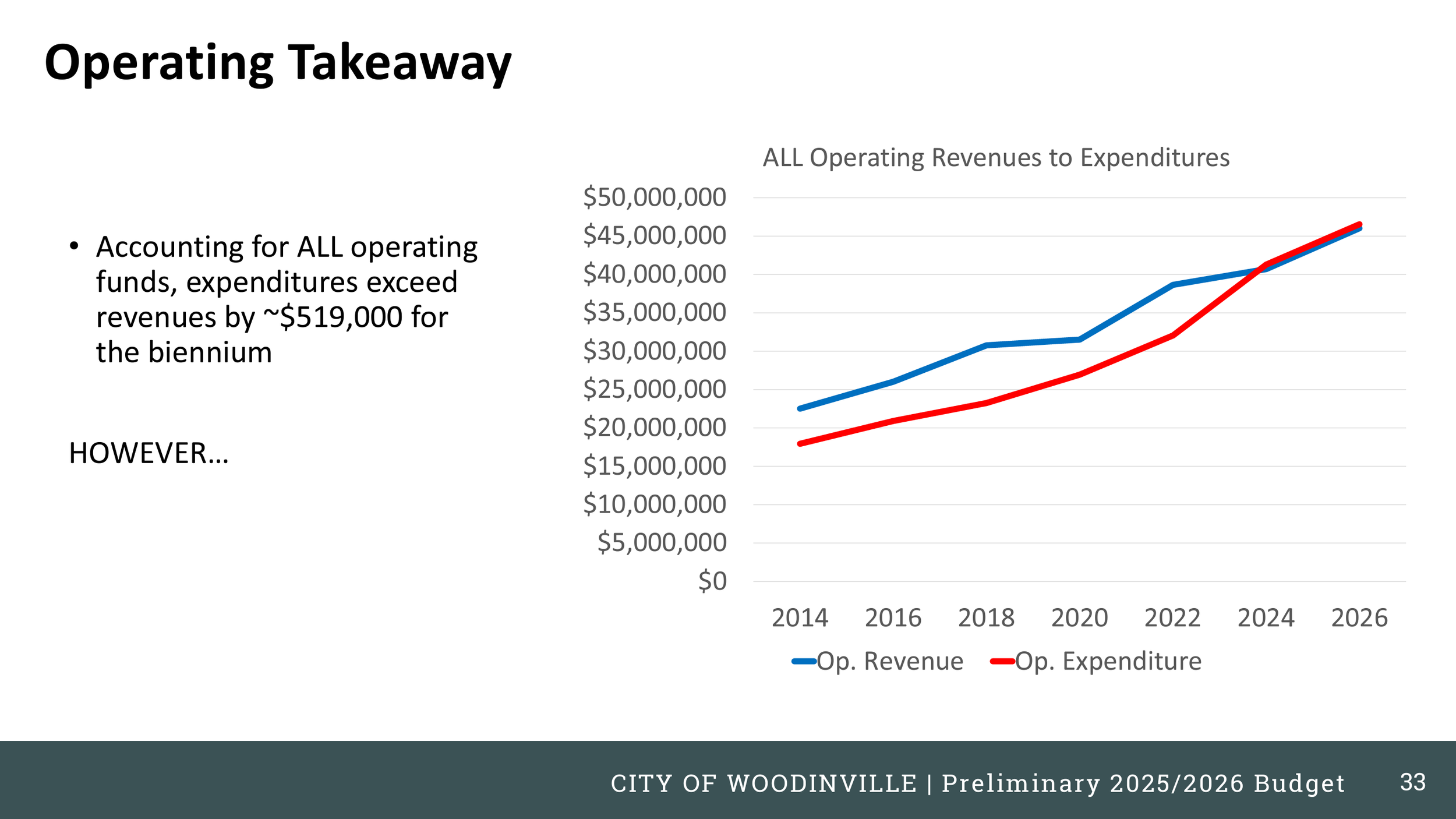

The City makes the budget easier to consume by creating slide decks that are presented at City Council meetings. One side effect of this approach is that the city can cherrypick the information that it wants to share and apply their own creativity in external communications. For example, at the October 15th, 2024 City Council meeting the city presented a slide deck claiming that the budget was balanced despite a clear operating deficit of $0.5 million.

Slide from the October 15th, 2024 Woodinville City Council meeting showing a $519,000 operating deficit.

The next slide goes on to say that if you remove development services, the budget is balanced. This is the equivalent of ignoring rent in your personal budget. You would end up with a misleading and unusable representation of your personal finances.

Breaking From Tradition

The City historically demonstrated excellent stewardship of public funds. Between 2012 and 2022, the City of Woodinville increased the size of its General Fund by between 7% and 17% every year except 2020 when tax revenue was impacted by Covid. The City Council acted decisively and cut costs to return the City to an annual surplus in 2021 and 2022.

This success was short lived. The first biennial budget led by the new City Council for 2023-2024 projected a $0.7 million operating deficit. In 2023, the Washington State Auditor’s Office (SAO) reported a $0.3 million decline in the General Fund and issued a “Cautionary” advisory.

Report from the Washington State Auditor’s Office (SAO) showing the City of Woodinville’s first General Fund deficit since 2020.

Where Are We investing?

The City is investing $64.8 million in capital projects to benefit roads, parks, streets, and conservation. This metric differs from capital expenditures (above) because it includes projects that are entirely developer funded. 59% of our capital investments ($38.3 million) are allocated to projects connected to the City’s risky initiative to rezone the General Business (GB) area north into an Eastrail Mixed Use (EMU) zone that would include dense housing, a linear park, and an eventual connection to the regional Eastrail trail system.

The City is hard selling the Eastrail initiative as a positive transformation for Woodinville that creates new affordable housing, meets state mandated growth targets, unlocks new commuting options, and is paid for by state and federal grants. This is misleading. The new EMU district does not mandate affordability and the City has no actual plan or intent to achieve affordability targets. It is infeasible to use the eventual trail to commute anywhere. For example, it would take three hours to walk from Downtown to Feriton Spur Gardens (near Google in Kirkland). Other cities are considerably further.

Here are some additional lowlights:

At least $6 million will be used to forcefully acquire land by eminent domain, which the City plans to give away to a municipal corporation in hopes that they will build a recreation center in the EMU district, which itself is dependent on a new property tax levy.

Less than half of the 2025-2026 Eastrail related costs are covered by grants.

$16.7 million (74%) of the $22.7 million in grant money is not yet received. State or Federal budget cuts outside of our control could put these awards at risk and could require us to cover the difference from the General Fund.

$7.1 million allocated to the Eastrail Multimodal Trail and $375,000 to the Wilmot Gateway Park boat launch and stage only covers design. The actual cost of these improvements is unknown and it is unclear how we will afford them. We will enter 2027 without a connection to Eastrail.

Plus, we’re already connected to Eastrail via the Sammamish River Trail at Wilmot Gateway Park. The key difference with the City’s plan is that the new EMU district would be directly connected to the trail without having to cross NE 175th St or 131st Ave NE. It’s a problem that does not currently exist because no one lives there today.

Breakout by Neighborhood

With the majority of the capital improvement budget allocated to a speculative initiative in an unpopulated part of the city, Woodinville’s existing neighborhoods will receive less investment. Three neighborhoods, Wellington, Leota, and West Ridge, comprise 54% of homes but will receive only 14% of the City’s capital investments:

Downtown

Homes: 36%

Investment: $46,059,000 (67%)

Woodinville Heights

Homes: 10%

Investment: $7,250,000 (11%)

Tourist District

Homes: 1%

Investment: $6,025,000 (9%)

Wedge

Homes: 12%

Investment: $4,177,333 (6%)

West Ridge

Homes: 23%

Investment: $3,119,000 (5%)

Wellington & Leota

Homes: 20%

Investment: $2,238,667 (3%)

Breakout by Use

The capital improvement plan heavily prioritizes streets and parks in the new EMU district and elsewhere in Downtown and the Tourist District. It also provides for surface water improvements in the EMU district and Woodinville Heights. One notable area of underinvestment is pedestrian and bike safety. Many Woodinville neighborhoods do not have adequate sidewalks or lighting (and in most cases) this will not be addressed in the 2025-2026 budget. In fact, the City allocated more budget to speculative land acquisition than to safety of current residents

Streets

Investment: $39,438,000 (57%)

SR 202 Widening and Trestle Replacement, street overlays (repaving), and downtown road grid improvements to accommodate future growth.

Surface Water

Investment: $9,005,000 (13%)

Management of stormwater and improvement of drainage systems, such as the Little Bear Creek culvert removal and NE 171st Street slope stabilization projects.

Parks

Investment: $8,185,000 (12%)

Enhancements to community spaces, including design of the Wilmot Gateway Park boat launch and performance stage, Woodin Creek tennis court refurbishments, and design of the Eastrail Multimodal Trail project.

Property Acquisition

Investment: $6,000,000 (9%)

Eminent domain of land to be given to the Northshore Parks and Recreation Service Area (NPRSA) in hopes of attracting a future recreation center in the EMU district.

Pedestrian/Bike Safety

Investment: $5,294,000 (8%)

Sidewalk extensions, crosswalks, and bike lane improvements.

Facilities

Investment: $947,000 (1%)

Temporary parking lot in the Tourist District and car chargers and security improvements to City Hall.

Bonus: Revenue Generating Cameras

Revenue generating machines (also known as “automatic traffic safety cameras”) in Bothell

You may recall from earlier in this article that the 2025-2026 biennial budget has a planned -$0.5 million operating deficit. The budget makes the very generous assumption that the City will receive $0.9 million in speed camera revenue.

Here’s the problem: Woodinville does not have any speed cameras and has not demonstrated a need. They can only be placed in school, park, or hospital zones. The City is looking for places to put speed cameras where it can maximize revenue. One idea raised in a 2024 City Council meeting was to place cameras near the Bright Horizons Daycare on 140th Ave NE, near KFC. If you assume $139 per ticket with 25% of revenue going to the state, 8,633 motorists or 63% of Woodinville’s population would have to receive a ticket in 2025-2026.

Without this revenue, the deficit increases to -$1.4 million.